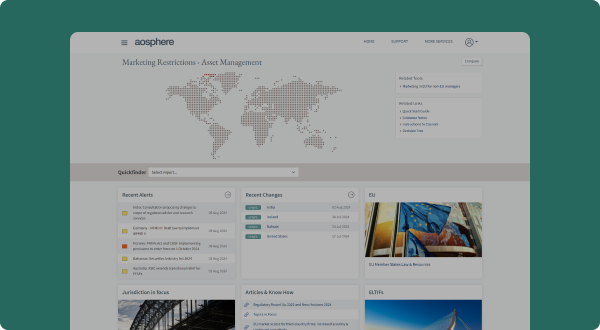

Rulefinder Marketing

Restrictions

- Asset Management

Confidently distribute funds and investment services. Worldwide.

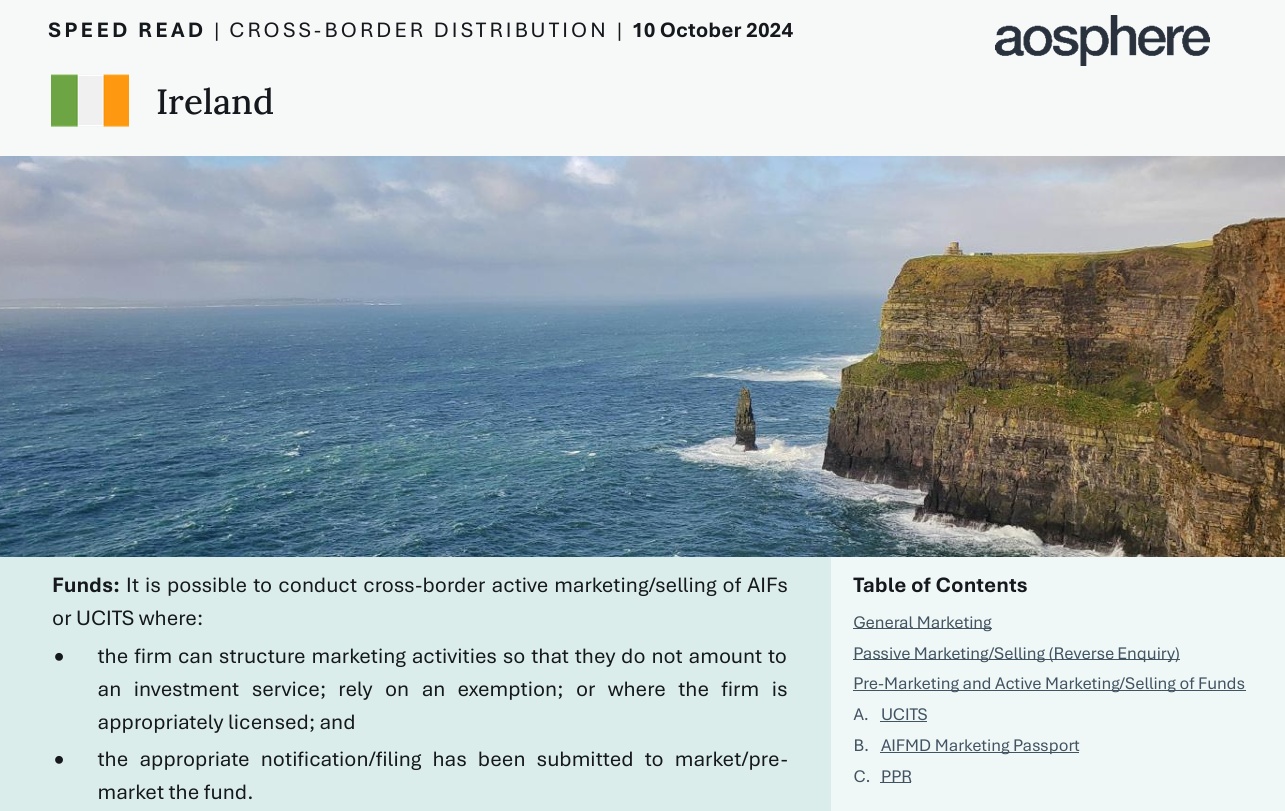

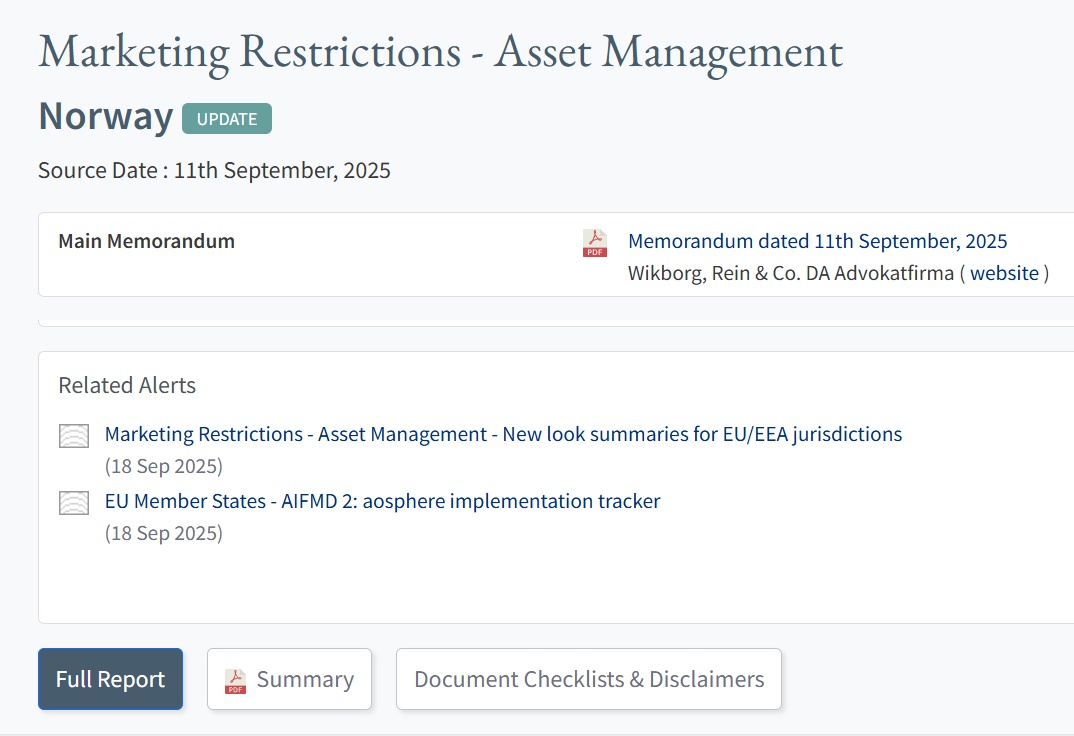

Rulefinder Marketing Restrictions – Asset Management (MR-AM) is a subscription-based online tool providing clear insights into cross-border marketing and selling rules across key global markets.

Benefits at a glance:

- Confident decision-making backed by a dedicated team of 10 senior legal specialists, collaborating with leading local counsel across key global markets

- Lower external legal spend through expert-led guidance and clear, jurisdiction-specific intelligence

- Proactive compliance with 150+ timely alerts each year to keep you ahead of regulatory change

- Flexible access via a simple annual subscription - no tie-ins, no fuss

Coverage includes

- The licensing requirements and exemptions applicable to cross-border marketing/selling of funds, managed accounts and investment management and advisory services

- The position for institutional and retail investors for 80+ jurisdictions

- For each jurisdiction, practical analysis of: general marketing, pre-marketing, reverse enquiry, private placement, and passporting schemes (e.g. AIFMD, UCITS and ELTIF)

Who it's for

Our subscribers include general counsel and other senior legal and compliance people, and business teams at asset management firms.

How it helps

We work with leading counsel across the globe to negotiate detailed memoranda of law which we provide alongside practical colour coded extracts.

The detail is there for those who need it, and available in summary format for those who don't.

aosphere is an incredible tool. It gathers in one easy-to-use format the expertise of local counsel in dozens of jurisdictions, so we can immediately see a high-level view of marketing regulations in a new market. It also provides a deeper level of research when we need more detail. It enables us to respond to requests by our sales partners much more quickly than pre-aosphere days.

aosphere subscriber

Product features

Jurisdictions covered

We provide consistent and comparable analysis across 80+ key jurisdictions.

Austria, Belgium, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Liechtenstein, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Russian Federation, Spain, Sweden, Switzerland, Turkey and United Kingdom

Abu Dhabi Global Market (ADGM), Bahrain, Botswana, Dubai International Financial Centre, Egypt, Israel, Jordan, Kenya, Kuwait, Mauritius, Morocco, Nigeria, Oman, Qatar, Saudi Arabia, South Africa and United Arab Emirates

Argentina, Bahamas, Bermuda, Brazil, British Virgin Islands, Canada (Alberta, British Colombia, Ontario and Quebec), Cayman Islands, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Panama, Paraguay, Peru, United States, Uruguay and Venezuela

Australia, Brunei, China, Hong Kong SAR, India, Indonesia, Japan, Kazakhstan (excluding AIFC), Macau SAR, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam

View sample content

Product team

Experienced senior lawyers

Rulefinder MR-AM is led by a team of senior financial services lawyers, many of whom have been with aosphere for nearly a decade. They began their careers at top-tier law firms before branching into roles such as in-house counsel at financial institutions, knowledge/professional support lawyers, or as senior practitioners at a regulator. Many have trained and practised internationally.

Now specialists in comparative legal analysis, they assess whether and how firms can conduct cross-border financial services and identify trends in this complex, ever-evolving landscape.

This diverse expertise, combined with a strong collaborative ethos, ensures the quality, consistency and practical value of our content.

Jenny Ljunghammer

Co-Head, FinReg Products

Penny Blair

Co-Head, FinReg Products

Emily Hillson

Specialist FinReg Lawyer

John Dyson

Specialist FinReg Lawyer

Kirsty Gibson

Specialist FinReg Lawyer

Kate Pang

Specialist FinReg Lawyer

Sarah-Jane Elsner

Specialist FinReg Lawyer

Serena McMullen

Specialist FinReg Lawyer

Sharon Gowdy

Specialist FinReg Lawyer

Luca Di Lorenzi

FinReg Specialist

Cross-Border Distribution FAQs

Reverse enquiry, or passive marketing, is where an investor proactively takes the initiative to contact a firm about a financial product or service (e.g. a fund). A firm may potentially be able to sell funds or provide services to an investor following a reverse enquiry without being authorised/licensed in the way they would have to be if they were actively marketing those funds/services to that investor.

Depending on the jurisdiction, it may be possible to respond to a reverse enquiry based on an official exemption or in other cases based on a tolerated practice. Care is needed as what constitutes a reverse enquiry varies. In general, it is important to document the reverse enquiry, but again, care is required, as how best to do so differs between jurisdictions.

PPR stands for “Private Placement Regime” which generally refers to where a firm markets/sells interests in funds to a limited number or sub-set of investors via a private placement i.e. not via a public offering. Generally, the requirements for a private placement are likely to be less onerous than those for a public offering.

In the EU, Member States may (but are not obliged to) have a National Private Placement Regime (NPPR) relevant to the sale of AIFs for which an AIFMD marketing passport is unavailable. In order to market an AIF via the NPPR of a Member State it is necessary to comply with: (i) conditions deriving from the AIFMD (Article 36, for EEA AIFMs marketing non-EEA AIFs or Article 42, for non-EEA AIFMs marketing any AIF); as well as (ii) any specific additional (or “gold-plating”) requirements set by that Member State.

Pre-marketing refers to any promotional activity testing the appetite of investors for a particular fund which may be undertaken before triggering a requirement to register with, or to notify, the regulators in a particular jurisdiction. For an activity to be classed as pre-marketing, an investor must not be able to purchase interests in a fund as part of the promotional activity. Not all jurisdictions have a concept of pre-marketing, in which case it is usually relevant to consider the rules that would apply to active marketing of the fund.

Pre-marketing is an important concept in the EU and EEA, as a notification or registration is always required once an activity amounts to active marketing, irrespective of whether a fund is being distributed via an NPPR or a marketing passport. Firms will want to know which activities can be performed before a marketing notification or registration is required.

At the EU level, the pre-marketing of EEA AIFs managed by EEA AIFMs has been harmonised under the Cross Border Distribution of Funds Directive (2019/1160/EU). Pre-marketing of such AIFs is therefore possible in any EEA jurisdiction before a marketing passport notification is made. However, there is currently no harmonised position in respect of the pre-marketing of UCITS or of other AIFs prior to the use of an NPPR. The position must therefore be checked on a jurisdiction-by-jurisdiction basis.

General marketing is the general promotion of a firm without the marketing of any specific fund or service. A number of activities could fall under general promotion, including the use of a logo, distribution of business cards, presenting at a conference or speaking on a panel, publishing articles or research, distribution of branded merchandise, displaying a banner at an event and raising awareness of product lines without referencing a specific fund/service. Firms are keen to understand if they can raise the profile of their brand, product or service lines without triggering restrictions that apply to active marketing of funds or investment services.

At aosphere we use the term Investment Management and Advisory Services to refer to the services of arranging, execution of orders on behalf of clients, investment advice and portfolio management, as set out in more detail below. These are the services which, in our view, are most relevant to asset managers who are looking to provide asset management services on a cross-border basis.

- Arranging, i.e. making arrangements for another person to buy, sell or subscribe for a fund or related services or passing execution instructions to a third party (also referred to as reception and transmission of orders or “RTO”);

- Execution of Orders on Behalf of Clients, i.e. agreeing to conclude agreements to buy or sell one or more financial instruments on behalf of clients;

- Investment Advice, i.e. providing personal recommendations to a client, either upon its request or at the initiative of the firm, in respect of one or more transactions relating to financial instruments; and

- Portfolio Management, i.e. the managing of portfolios in accordance with mandates given by clients on a discretionary client-by-client basis where such portfolios include one or more financial instruments.

“UCITS” stands for “Undertakings in Collective Investments in Transferable Securities”. These are EEA funds that comply with the UCITS VI Directive (2009/65/EC) and benefit from a marketing passport in the EEA. They are open-ended retail funds which may only invest in certain types of assets, e.g. transferable securities, money-market instruments, derivatives and certain funds. Although only EEA funds can be UCITS funds, the UCITS brand is well-recognised by international investors and is something of a benchmark for other funds worldwide.

“AIF” stands for “Alternative Investment Fund” and essentially means any fund that is not a UCITS fund. AIFs are governed by the Alternative Investment Fund Managers Directive (2011/61/EU), which aims to create an internal market for the managers of AIFs and a harmonised framework for their activities within the EEA.

Some non-EEA jurisdictions may adopt their own national definition of an alternative investment fund or AIF, with the term generally referring to a fund which may not be available to retail investors.

“ELTIF” stands for “European Long Term Investment Fund”, which is a specialist form of AIF governed by the ELTIF Regulation (EU) 2015/760 as amended by the ELTIF Regulation (EU) 2023/606. ELTIFs allow professional and retail investors to invest in products and companies that require long-term capital. To qualify as an ELTIF, an AIF must comply with certain diversification rules, limit leverage and derivative use and have an authorised AIFM. It must also publish a prospectus and provide information on the redemption of units/shares and information about the illiquid nature of the AIF. Additional requirements are necessary if the ELTIF is to be marketed to retail investors.

A marketing passport allows a firm to market/sell a fund to investors in other jurisdictions without needing significant additional approvals from the regulators in those target (or host) jurisdictions.

Marketing passports are available in the EEA for UCITS, ELTIFs and AIFs (provided they are EEA AIFs with EEA AIFMs and the investors are professional investors). Outside the EEA, there are a number of mutual recognition schemes which have a similar effect, such as the Association of Southeast Asian Nations (ASEAN) CIS Framework in Asia or the fund passporting scheme for domestic funds between the onshore UAE, the DIFC and the ADGM. The Hong Kong SAR, in particular, has entered into mutual recognition arrangements with a number of countries including the recently announced Hong Kong-UAE mutual recognition of funds arrangement. The Gulf Co-operation Council countries are also in the process of implementing a fund passporting framework among themselves in the Middle East.

“Gold-plating” or “super-equivalence” refers to where a national competent authority (NCA) of an EEA Member State exercises its permitted discretion to impose additional restrictions or more stringent requirements over and above those imposed under EU law.

Administrative fines can potentially be very high. For example, in the UK a breach of the financial promotion restriction resulting in a conviction on indictment could lead to an unlimited fine. In Germany, the marketing or sale of a fund without notifying or registering with BaFin could result in a fine of up to EUR 5,000,000, with responsible individuals being fined up to EUR 1,000,000. In the US, wilful violation of the Commodity Exchange Act and Commodity Futures Trading Commission Rules may constitute a felony punishable by a fine of up to USD 1,000,000.

Potentially, yes. The majority of the jurisdictions we survey may impose criminal penalties for breach of marketing restrictions. For example, in its statement on reverse solicitation on 13 January 2021, ESMA reminded non-EEA firms that the provision of investment services in the EU without proper authorisation under EU and applicable national Member State law exposes service providers to the risk of administrative or criminal proceedings.

The below is a sample of the types of topics covered for certain selected jurisdictions on aosphere’s Marketing Restrictions – Asset Management.

Australia

- Is it possible to offer a fund in Australia where the activity is with Wholesale Clients only?

- Can I use the exemption for Limited Connection Relief to offer a fund in Australia?

- Can I use the Sufficient Equivalence Relief to offer a fund in Australia?

- Until when has the relief for foreign financial service providers (FFSPs) been extended in Australia?

- For firms from which countries is the Sufficient Equivalence Relief available in Australia?

- What is the latest status of the foreign AFSL regime in Australia?

Canada

- Can I use the Accredited Investor Exemption to offer a fund in Canada?

- Can I use the International Dealer Exemption to offer a fund in Canada?

- Can I use the Permitted Client Exemption to offer a fund in Canada?

- Will I need a wrapper for my offering document in order to offer a fund in Canada?

- What kind of wrapper do I need for my offering document in order to offer a fund in Canada?

- What are the specific requirements that apply in Alberta if I want to offer a fund there?

- What are the specific requirements that apply in British Colombia if I want to offer a fund there?

- What are the specific requirements that apply in Ontario if I want to offer a fund there?

- What are the specific requirements that apply in Quebec if I want to offer a fund there?

- Do my fund documents need to be in French if I’m offering a fund in Quebec?

- What is the Ontario Capital Markets Participation Fee. How do I know if I need to pay it and how do I pay it?

Japan

- Can I use the QFI exemption to market or sell a fund in Japan?

- Does the QFI exemption only apply to activities conducted remotely rather than onshore in Japan?

- What conditions must be fulfilled to use the Article 63 Exemption in Japan?

- Do I need to create a feeder fund to use the Article 63 Exemption in Japan?

- How do I know whether the Paragraph I Security Disclosure Exemption or the Paragraph II Security Disclosure Exemption applies in Japan?

- What is the definition of a QII in Japan in the context of the Disclosure Requirement?

Kuwait

- Can I use the GCC fund passporting regime in Kuwait?

- Is there a tolerated practice in Kuwait?

- Does the tolerated practice depend on whether I conduct the activities remotely or onshore in Kuwait?

- Do I need to appoint a marketer in Kuwait in relation to my fund offering?

The type of questions MR-AM considers

General marketing

- Is general brand marketing permitted e.g. use of name or logo?

- Is publishing articles e.g. thought leadership pieces or research papers permitted?

- Is marketing by means of awareness raising of product/service lines permitted (without reference to a specific Fund or service)?

- Is marketing particular characteristics or an investment strategy permitted (without reference to a specific Fund or service)?

- Is speaking at a finance-related event permitted?

- Is distributing a business card permitted?

Passive marketing (reverse enquiry)

- What constitutes a "reverse-enquiry" / "reverse solicitation"?

- Must a "reverse-enquiry" / "reverse-solicitation" relate to a specific AIF or can it be more general?

- Does it make a difference if there is a pre-existing relationship?

- Does it matter if a third party intermediary made the approach?

- Are there any practical compliance procedures that are advised?

- Does the analysis change for passported and non passported funds?

Private Placement Regimes

- Is active marketing via the PPR permitted? Are there restrictions on selling?

- Are there notification or approval requirements before marketing can commence?

- Is an intermediary required?

- Does Fund structure or investment strategy impact the rules?

- Marketing via telephone, email, hard copy written materials, fly-ins, fly-outs, intermediaries, branding, internet marketing (including social media).

- Written & oral disclaimer language (legends).

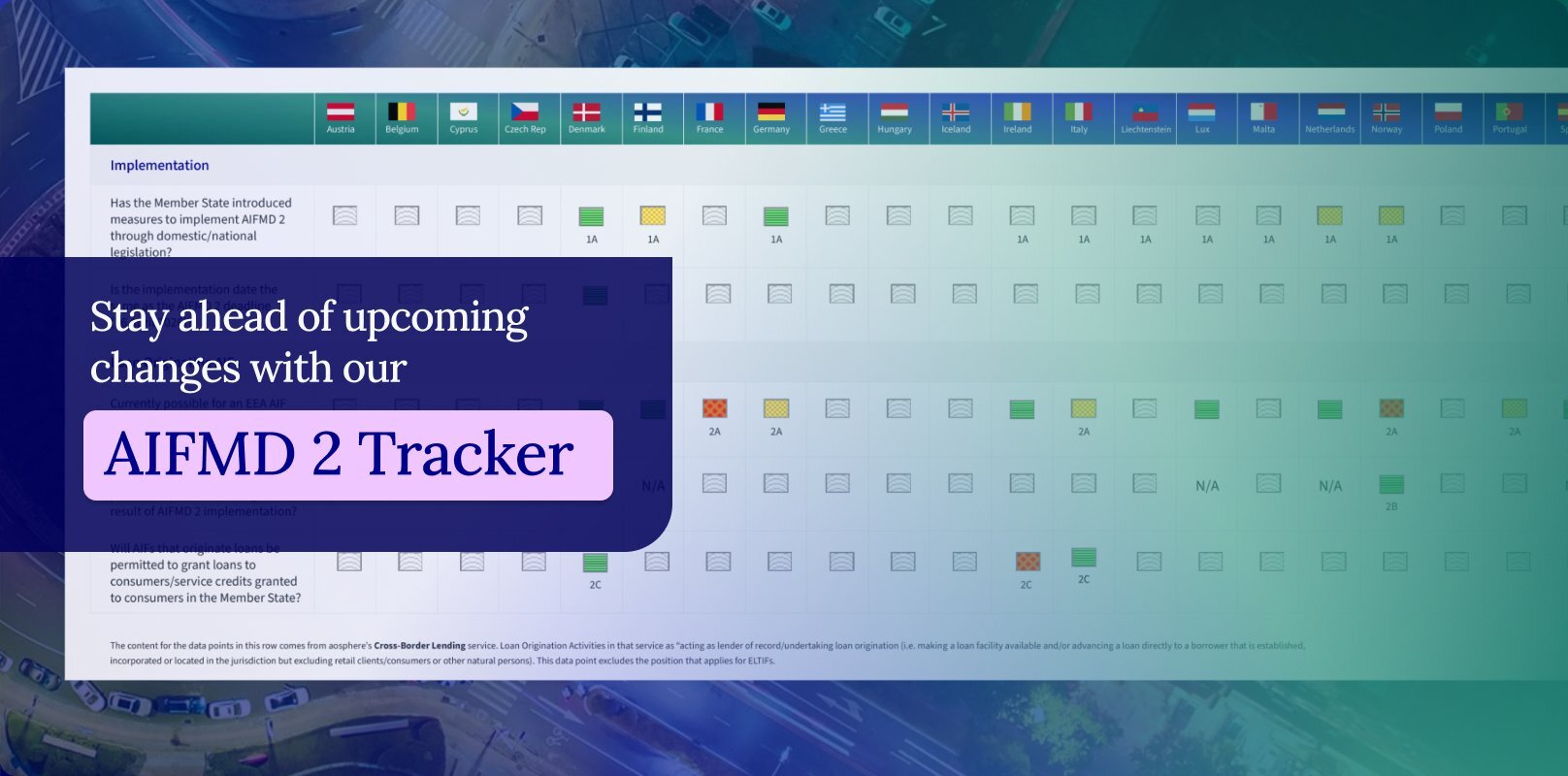

Passporting Schemes (UCITS & AIFMD)

- Dedicated European Framework Document provides a comprehensive overview of European legislation.

- EEA coverage examines the impact of EU law, including AIFMD (Directive 2011/61/EU), UCITS (Directive 2009/65/EC), MiFID II (Directive 2014/65/EU and Regulation 600/2014), the Prospectus Directive and the Prospectus Regulation (2017/1129).

- EEA coverage sets out position when using AIFMD Marketing Passport compared to marketing via Article 36 and Article 42 AIFMD.

- Detailed analysis of "AIFMD Marketing" and "Pre-Marketing" for each jurisdiction.

- Monitoring of other regional arrangements for passporting/mutual recognition of Funds across APAC e.g. the Hong Kong-China mutual fund recognition scheme, Hong Kong-Switzerland mutual recognition scheme, Hong Kong-France mutual recognition scheme, ASEAN CIS Framework and the Asia Region Funds Passport.

- Analysis of active marketing via AIFMD Marketing Passport, UCITS (passport and non passported), plus notification process and approval requirements.